Estimated reading time: 3 minutes

Introduction

An LLC Operating Agreement serves as the core legal instrument that governs how a Limited Liability Company (LLC) functions on a daily basis. It defines the company’s structure from formation to dissolution and explains in detail how members manage operations, make decisions, and distribute profits. Furthermore, it clarifies capital contributions, voting rights, and ownership responsibilities so that each member understands their role. By setting clear rules for governance and accountability, the agreement strengthens internal cooperation, protects every member’s interests, and ensures ongoing compliance with all relevant business regulations.

Purpose and Legal Relevance

An LLC Operating Agreement establishes a precise legal structure that guides how a company operates and how its members interact. Even though some jurisdictions may not require a written document, every company benefits from having one because it clearly defines managerial powers, financial procedures, and each member’s rights and obligations.

In addition, it reduces the likelihood of internal disputes, reinforces limited liability protections, and strengthens the company’s credibility in contractual, financial, and regulatory matters.

Furthermore, most legal systems allow business owners significant flexibility to adapt their operating agreements to their specific objectives. Through this adaptability, companies can determine how profits are distributed, how new members join, and how disagreements are settled. As a result, the agreement transforms from a formal requirement into a dynamic governance tool that aligns business management with long-term strategic goals.

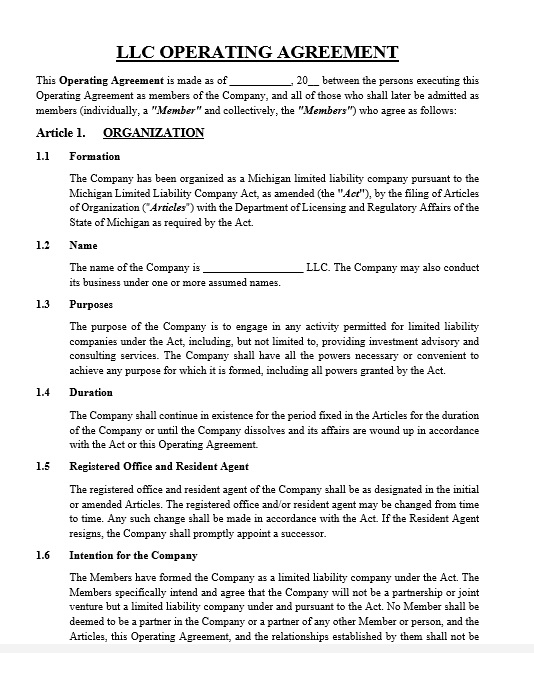

Core Components of an LLC Operating Agreement

Key sections typically found in an LLC Operating Agreement include:

- Organization and Formation: Specifies the state of registration, name, and duration of the company.

- Purpose and Powers: Defines the scope of activities the LLC is authorized to perform.

- Capital Contributions: Details each member’s initial and additional investments.

- Allocations and Distributions: Outlines how profits, losses, and distributions are divided among members.

- Management Structure: Identifies whether the company is member-managed or manager-managed and assigns decision-making authority.

- Voting and Meetings: Establishes voting rights, quorum requirements, and meeting procedures.

- Indemnification and Liability: Protects members and managers from personal liability when acting in good faith.

- Dissolution and Winding-Up: Defines when and how the company will be dissolved and assets distributed.

These provisions together create a balanced and transparent operational framework, ensuring that all members act in accordance with shared objectives and defined responsibilities.

Benefits and Practical Application

A well-drafted LLC Operating Agreement delivers several strategic benefits:

- Legal Protection: Reinforces limited liability status by separating personal and business assets.

- Governance Clarity: Prevents disputes by documenting management authority and voting rules.

- Financial Transparency: Provides a clear record of capital contributions and distributions.

- Continuity: Establishes succession procedures for membership changes or dissolution events.

Whether an LLC has a single member or multiple owners, the Operating Agreement serves as the blueprint for corporate governance, ensuring legal compliance and operational efficiency.

For further reference, you may review the following related templates:

- Stock Purchase Agreement (SPA)

- Partnership Agreement

- Business Buy-Sell Agreement

- Franchise Agreement

- Consortium Agreement

- Waiver of Liability Agreement

References (2023–2025)

- U.S. Small Business Administration (SBA). (2024). Guide to Forming an LLC.

- Internal Revenue Service (IRS). (2023). Limited Liability Company Tax Information.

has been added to your cart!

have been added to your cart!