Estimated reading time: 7 minutes

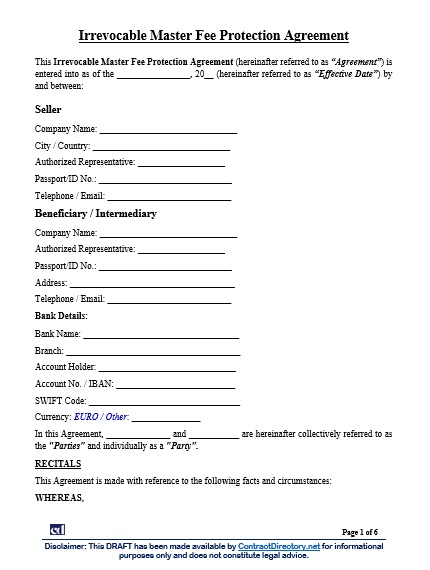

An Irrevocable Master Fee Protection Agreement (IMFPA) is a contractual framework used in commodity and financial trade to secure commission payments for intermediaries. It provides a binding mechanism for distributing fees once the underlying transaction, usually a Sales & Purchase Agreement (SPA), is performed. Because intermediaries have no control over the principal contract, the IMFPA establishes how, when, and by whom their commission is paid.

Despite wide use, most IMFPA templates circulating online are inconsistent, and many include unenforceable clauses, outdated ICC references, and unclear payment structures. A properly drafted IMFPA must be tied directly to the transaction it protects and must be coordinated with the associated Non-Circumvention, Non-Disclosure Agreement (NCNDA). Otherwise, the intermediary’s right to a commission becomes weak or unprovable.

This article explains how an Irrevocable Master Fee Protection Agreement works, how to link it to an NCNDA, and the practical legal safeguards you need before using one in any jurisdiction.

1. What an Irrevocable Master Fee Protection Agreement Actually Protects

The IMFPA protects payment of commissions. Nothing more.

It does not guarantee the existence of the underlying deal, and it does not prevent circumvention on its own. It simply converts the Seller’s (or sometimes Buyer’s) promise into a contractual obligation, often supported by:

- Bank pay orders

- Split-payment instructions

- Escrow/disbursement mechanisms

- Standing payment orders lodged with the Seller’s bank

For intermediaries, the IMFPA is the document that contains the fee schedule, percentages, beneficiaries, and the timing of disbursement after each completed shipment or tranche.

However, for the IMFPA to work, it must be:

- Irrevocable,

- Linked explicitly to the SPA (with contract number, date, commodity, volume),

- Supported by enforceable governing law and arbitration,

- Connected to the NCNDA, which protects the intermediary’s relationship and contact chain.

2. Practical Legal Advice Before You Sign Any IMFPA

(1) Have a local lawyer review the enforceability

A lawyer in the relevant jurisdiction should validate:

- governing law choice (often English law or Singapore law),

- interest and late-payment clauses,

- enforceability of non-circumvention language,

- enforceability of the arbitration clause.

Different countries have very different views on NCNDA and fee-protection enforceability.

(2) Always link the IMFPA to the specific SPA

The SPA reference must include:

- SPA date and number

- Buyer and Seller’s full legal names

- Commodity (e.g. diesel EN590, sugar ICUMSA, LNG)

- Monthly quantity and shipment schedule

- Incoterms

If you fail to link them, the Seller can later argue: “This IMFPA is general. It does not apply to this specific contract.”

(3) Negotiate real bank-level disbursement whenever possible

A Seller’s signature is not the same as a bank execution.

The strongest IMFPA mechanism is:

- Split Payment / Bank-to-Bank Disbursement:

Buyer pays into Seller’s bank → bank is instructed to automatically divide funds:- Net proceeds to Seller

- Commission to intermediaries

If impossible, aim for:

- Escrow-based commission release, or

- Standing payment orders lodged and acknowledged by the Seller’s bank.

Anything less becomes hard to enforce internationally.

(4) Tailor governing law and arbitration to the jurisdictions involved

If you provide the countries of the Seller and Buyer, a more precise clause can be drafted. Examples:

- UAE + UK → English law + LCIA arbitration

- EU + US → Swiss law + ICC arbitration

- Africa + Middle East → English law + ICC arbitration

Bad governing-law clauses are one of the main reasons IMFPA disputes cannot be enforced.

3. How NCNDA and IMFPA Work Together in Trade Deals

An NCNDA and an IMFPA protect different aspects of the intermediary’s risk:

| Document | Function |

|---|---|

| NCNDA | Protects relationships, prevents circumvention, and maintains confidentiality. |

| IMFPA | Protects the actual commission and the payment mechanism after the deal closes. |

Used together, they create a contract chain:

LOI / ICPO → NCNDA → SPA → IMFPA → Bank Disbursement

The mistake most people make is treating these as unrelated templates. They must be synchronized.

4. How to Link an IMFPA With an NCNDA (Correct Method)

A. Match Parties and Definitions

Both documents must use:

- identical legal names,

- identical addresses,

- consistent roles (Buyer, Seller, Intermediary, Mandate, Facilitator),

- the same definition of “Transaction” and “Commodity”.

If the NCNDA defines “Introducer” or “Intermediary”, the Irrevocable Master Fee Protection Agreement must reference that definition.

B. Cross-Reference From the NCNDA

A clean legal clause (your lawyer can refine):

“The Parties acknowledge that fees and commissions payable to any intermediary in connection with the Transactions covered by this Agreement shall be governed by a separate Irrevocable Master Fee Protection Agreement (“IMFPA”). The IMFPA forms an integral part of the contractual framework between the Parties.”

This ensures no SPA can escape the fee obligations.

C. Cross-Reference From the Irrevocable Master Fee Protection Agreement (IMFPA)

In the IMFPA’s recitals, add:

“This IMFPA is executed further to and as an integral part of the NCNDA dated [____] between the same Parties. Both agreements relate to the identical transaction(s) defined under Reference Code [_____].”

This locks the two documents together legally.

D. Use a Single Transaction Reference Code

For example:

“Project Delta – EN590 Diesel – 100,000 MT/month – 2026”

Use this same reference in:

- NCNDA header

- IMFPA header

- SPA preamble

- Fee schedule annex

This removes ambiguity and defeats circumvention attempts.

E. Align Duration and Scope

To avoid loopholes:

- NCNDA: non-circumvention for 2–5 years

- IMFPA: commission protection for all rollovers, renewals, or new SPAs between the same Buyer and Seller introduced during the NCNDA period

Both documents should say they apply to:

- rollovers

- extensions

- new contracts

- addenda

- amended contracts for the same commodity or similar commodities

F. Make NCNDA + IMFPA Reinforce Each Other

In the NCNDA:

If a party circumvents the intermediary, the intermediary is entitled to the commission defined in the IMFPA.

In the IMFPA:

Any deal between Buyer and Seller arising from introductions made during the NCNDA period automatically triggers commissions.

These mirror clauses create interlocking obligations.

5. Recommended Signing Structure

Most professional traders follow this order:

Step 1 — NCNDA

Signed when introductions and documents (LOI, ICPO, KYC) start flowing.

Step 2 — IMFPA

Signed when the SPA is drafted or agreed.

Both agreements should use:

- the same governing law,

- the same arbitration institution,

- the same seat of arbitration,

- the same definition of the transaction.

That allows a single tribunal to interpret both together.

6. Practical Drafting Tips for Intermediaries

✔ Do not use generic “ICC IMFPA” or “ICC NCNDA” downloads.

The ICC does not issue official templates for these documents. Most versions online are unofficial, outdated, and legally weak.

✔ Consider merging NCNDA + IMFPA into a single “Intermediary Protection Agreement.”

This avoids inconsistencies.

✔ Push for bank-executed disbursement (split payment).

It is the only mechanism that provides real enforcement, especially across borders.

✔ Identify your role clearly.

Are you a mandate? A facilitator? A broker?

Courts enforce clear roles; vague roles result in unenforceable claims.

✔ Keep evidence of your introduction work.

Emails, WhatsApp messages, term negotiations, draft SPA exchanges, these prove you are the effective cause of the contract.

7. When IMFPA Protection Fails

Intermediaries most often lose commissions because of:

- IMFPA is not tied to a specific SPA

- No bank acknowledgment of payment instructions

- Different names or roles in NCNDA vs IMFPA

- Wrong or unenforceable governing law

- No arbitration seat or flawed arbitration clause

- Circumvention occurring before the IMFPA is signed

- Using unreviewed templates from the internet

Every point above can be fixed by proper drafting.

Conclusion

A properly structured IMFPA is a powerful tool for securing commissions in international commodity trade. However, it only works when:

- the IMFPA and NCNDA are fully synchronised,

- the SPA is referenced clearly,

- bank-disbursement or escrow mechanisms exist,

- governing law and arbitration are chosen strategically,

- and drafting is precise.

With these elements aligned, intermediaries significantly increase their ability to enforce fee rights, even across multiple jurisdictions and rolling long-term contracts.

If you specify the commodity (e.g., EN590, LNG, sugar, gold) and the jurisdictions of the Buyer and Seller, a fully tailored NCNDA + IMFPA package can be drafted with jurisdiction-specific clauses suitable for real transactions.

Check out more pages of our website for related content:

- Non-Circumvention Non-Disclosure Agreement (NCNDA)

- ICC Non-Circumvention & Non-Disclosure Agreement

- Sales Agreement

- Intermediary Contract (Trade)

- Irrevocable Commission Payment Guarantee

Access the Full Contract Directory Index

You can browse the complete alphabetical list of all commercial, financial, and project-based contract templates by visiting our A–Z Contract Index.

References:

- CJ Horn Attorneys – The Irrevocable Master Fee Protection Agreement (IMFPA) – A 2025 legal overview explaining how the IMFPA integrates into commercial contracts to automate commission payments through banking systems.

- Global Negotiator – What is IMFPA Agreement? Definition and Meaning – A trade dictionary entry detailing the use of IMFPAs in bulk commodity transactions to protect intermediary fees globally.

- NNRV Trade Partners – How to Protect Your Commission in a Petroleum Transaction – A 2025 strategic analysis of aligning commission chains with banking reality and ICC non-circumvention rules…

has been added to your cart!

have been added to your cart!