Estimated reading time: 3 minutes

Fundraising in the investment landscape refers to the structured process of obtaining capital or financial backing from investors to support diverse business ventures. These ventures may include the launch of a new startup, the expansion of an existing enterprise, or the financing of large-scale projects. Investors contribute funds through a variety of methods, such as venture capital, angel investing, crowdfunding, or loans, each offering distinct benefits and obligations.

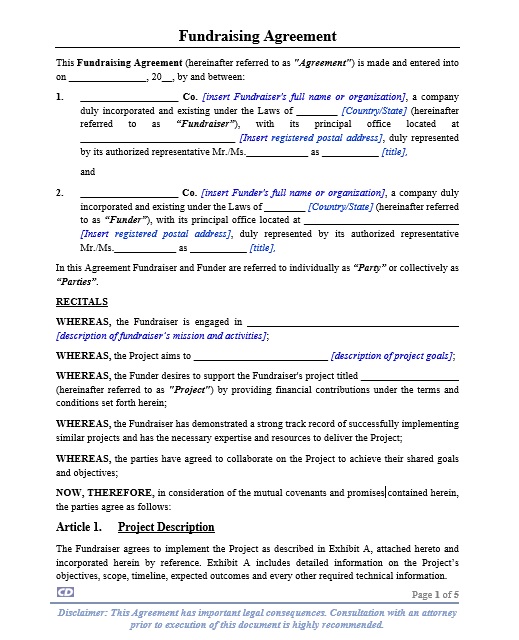

To streamline and formalize this process, companies and financial intermediaries often enter into a Fundraising Agreement. This legal document clearly defines the objectives, scope, and terms of cooperation between the fundraising company and the client seeking investment. It establishes a framework for accountability, ensuring that both parties adhere to their responsibilities while minimizing potential disputes.

Purpose and Importance of Fundraising

Fundraising serves as a cornerstone for business development, particularly for startups and SMEs that lack sufficient internal capital. Without access to external financing, these entities may struggle to sustain operations or pursue growth opportunities. Through effective fundraising, companies can unlock the capital necessary to develop products, expand into new markets, or invest in technology and innovation.

Moreover, fundraising is not merely about acquiring money; it is a strategic act that strengthens investor confidence and opens pathways to new partnerships. By demonstrating transparency and accountability through a written agreement, businesses enhance their credibility and increase their likelihood of attracting quality investors.

Methods of Fundraising

Different forms of fundraising cater to various financial structures and business goals:

- Venture Capital (VC): Offers large-scale funding to startups in exchange for equity, often accompanied by mentorship and strategic guidance.

- Angel Investment: Involves high-net-worth individuals investing their personal funds in promising early-stage ventures.

- Crowdfunding: Enables businesses to raise smaller amounts from a large number of contributors via online platforms.

- Bank Loans and Private Debt: Traditional lending options for companies with a stable credit history and predictable cash flows.

Selecting the appropriate method depends on the company’s financial health, growth potential, and risk tolerance.

Structure of a Fundraising Agreement

A well-drafted Fundraising Agreement defines the responsibilities, fees, success metrics, and timeframes of the collaboration. Common clauses include:

- Scope of Services: Describing the fundraising activities and target capital amount.

- Fee Structure: Detailing commissions, retainers, or success fees.

- Confidentiality and Non-Disclosure: Protecting sensitive financial data and business strategies.

- Termination and Dispute Resolution: Outlining procedures in case of early termination or conflict.

By documenting these details, the agreement ensures clarity, compliance, and legal protection for both parties.

Conclusion

Fundraising is more than a financial transaction; it is a strategic partnership built on trust, planning, and clarity. A transparent Fundraising Agreement not only safeguards the interests of both parties but also fosters confidence among investors. In today’s competitive market, the ability to secure funding efficiently and ethically determines whether a business merely survives or truly thrives.

Related Topic:

Reference List

- OECD – Financing Growth and Innovation (2024)

- World Bank – Investment and Capital Mobilization

- Harvard Business Review – Effective Fundraising Strategies for Startups

- Investopedia – What is Fundraising?

- Startup Genome – Global Startup Ecosystem Report 2024

has been added to your cart!

have been added to your cart!