In the European Union (EU), customs clearance involves various forms depending on the type of goods, customs procedure, and specific requirements. Below is a list of commonly used customs clearance forms in the EU:

Import and Export Declaration Forms

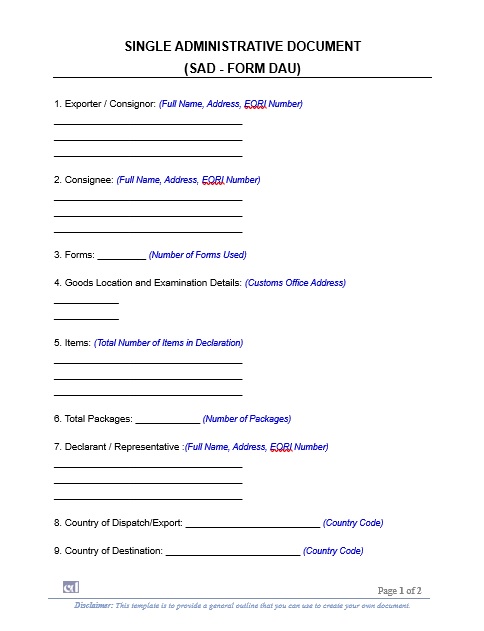

Companies use the Single Administrative Document (SAD – Form DAU) for import, export, and transit operations. This document standardizes customs procedures across the EU.

The SAD-Form DAU consists of eight copies, each serving a specific function:

- Copy 1 – Retained by the exporting country’s customs.

- Copy 2 – Sent to EU statistical authorities for data recording.

- Copy 3 – Kept by the exporter as proof of export.

- Copy 4 – Used by import authorities in the destination country.

- Copy 5 – Serves as a receipt for transit procedures.

- Copy 6 – Remains with the customs office of entry for verification.

- Copy 7 – Acts as a control document for monitoring shipments.

- Copy 8 – Retained for any special customs procedures when applicable.

The form is structured into 56 fields, each requiring specific details about the goods, origin, value, and trade details.

The Customs Declaration System (CDS) processes import and export declarations electronically, reducing paperwork.

The Customs Value Declaration (DV1 Form) applies to imports exceeding €20,000. Traders must submit this form to confirm the correct customs value. Businesses also need an EORI (Economic Operators Registration and Identification) Number when trading with non-EU countries.

Transit and Trade Facilitation Documents

The T1 Form applies to non-EU goods moving under transit procedures. Meanwhile, traders use the T2 Form for EU goods moving within the EU or to EFTA countries. The TIR Carnet allows goods to travel across multiple customs territories with fewer checks.

The EUR.1 Certificate provides preferential tariff rates under EU trade agreements. The A.TR Certificate simplifies trade between the EU and Turkey, allowing duty-free movement for specific goods.

Excise, VAT, and Special Customs Procedures

Traders handling excise goods such as alcohol, tobacco, and fuel must submit an Excise Movement and Control System (EMCS) Declaration. VAT-related forms, like VAT 21 and VAT 23, cover intra-EU transactions.

Customs Warehousing Authorization enables duty-free storage for businesses that need special customs treatment. The Inward Processing Authorization (IPR) allows the duty-free import of materials for processing. The Outward Processing Authorization (OPR) permits the temporary export of goods for processing before re-importation.

Safety and Security Compliance

The Entry Summary Declaration (ENS) applies to goods entering the EU. Customs authorities require this form before arrival for risk assessment. The Exit Summary Declaration (EXS) ensures goods leaving the EU meet safety and security regulations.

Understanding these forms simplifies customs processes and prevents unnecessary delays. Traders should comply with EU regulations to ensure seamless cross-border trade.

References

- European Commission – Customs and Taxation

https://taxation-customs.ec.europa.eu - World Customs Organization – Transit and Trade Facilitation

https://www.wcoomd.org - EU Trade Helpdesk – Import and Export Procedures

https://trade.ec.europa.eu/tradehelp

has been added to your cart!

have been added to your cart!