Managing Inflation and Exchange Rate Risks

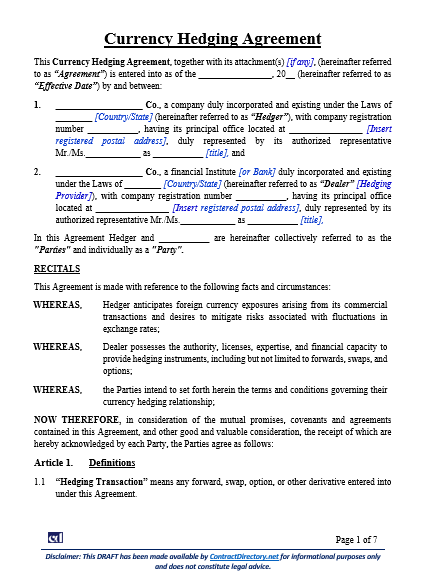

A Currency Hedging Agreement is a legal contract between a business (the “Hedger”) and a financial institution (the “Dealer”). It establishes the terms and conditions under which the Hedger uses financial instruments such as forwards, swaps, or options to manage risks arising from fluctuations in foreign exchange rates. By formalising the arrangement, the agreement ensures both clarity and protection for the parties involved.

Purpose and Scope

The main purpose of a Currency Hedging Agreement is to reduce the impact of unpredictable currency movements on international transactions. The scope of the agreement generally includes the types of hedging transactions permitted, such as forward contracts to lock in an exchange rate, or swaps and options that provide flexible risk management strategies.

Provisions

The agreement usually defines terms such as Confirmation, Settlement Date, and Default Currency to ensure consistency. It sets obligations for payments, outlines settlement procedures, and clarifies tax and withholding responsibilities. Confidentiality clauses protect sensitive information, while indemnity provisions ensure that each party bears responsibility for its own breaches or misconduct.

Risk Mitigation and Collateral

To further secure obligations, the agreement may include provisions on margin and collateral. These measures ensure that the Hedger maintains sufficient security to cover potential exposure. In case of disputes or defaults, the agreement often provides for close-out netting, allowing obligations to be balanced into a single payable sum.

Legal and Practical Importance

A Currency Hedging Agreement provides businesses with financial stability in cross-border transactions. By formalising responsibilities, it supports transparent risk management, compliance with relevant laws, and smoother international trade operations. It also establishes mechanisms for dispute resolution, force majeure events, and termination, thereby safeguarding the interests of both parties.

Conclusion

In global commerce, exchange rate volatility can have significant financial consequences. A Currency Hedging Agreement gives companies the framework to manage this risk effectively. It protects both the Hedger and the Dealer by clearly defining obligations, remedies, and procedures, allowing international business transactions to proceed with greater confidence.

References

- Investopedia – Hedging Definition

- Corporate Finance Institute – Currency Hedging

- Bank for International Settlements – Derivatives Statistics

- OECD – Risk Management in International Business

has been added to your cart!

have been added to your cart!