Estimated reading time: 3 minutes

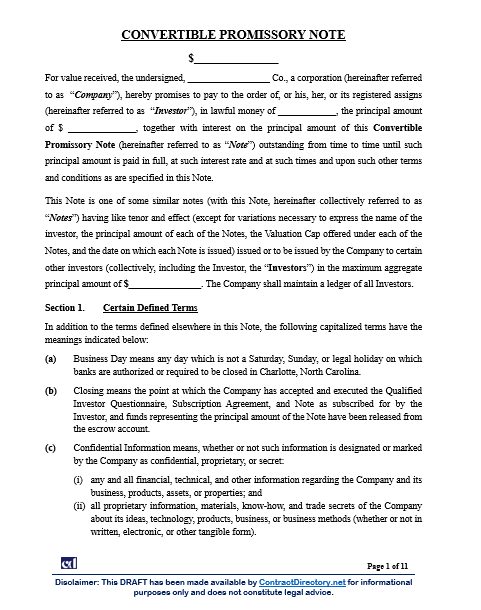

A Convertible Promissory Note is a financial instrument that functions as both a loan agreement and a future equity contract. It is commonly used by startups and early-stage companies to raise capital without immediately determining a company valuation. Through this instrument, an investor lends money to the company, and under defined conditions, the debt converts into equity rather than being repaid in cash.

Structure and Purpose of Convertible Promissory Note

At its core, a Convertible Promissory Note operates as a debt instrument. The company, known as the issuer, receives funds from an investor and promises repayment of the principal amount with interest. However, instead of settling the debt in cash, the note allows conversion into shares when a future financing event occurs, such as a qualified investment round. This structure enables startups to attract investors quickly while postponing valuation discussions until a larger, priced round is arranged.

Terms and Mechanisms

Several essential clauses define how a Convertible Note functions:

- Principal and Interest – The note specifies the amount invested and the annual interest rate, typically between 3% and 8%. Interest accrues until conversion or repayment.

- Maturity Date – This is the deadline for repayment or conversion, usually set between 18 and 24 months.

- Conversion Trigger – When the company completes a qualified financing (for example, raising more than a fixed amount), the note automatically converts into equity shares.

- Conversion Discount – To reward early risk, investors often receive shares at a discounted rate compared to new investors, commonly between 10% and 30%.

- Valuation Cap – This sets the maximum company valuation at which the note converts, protecting investors from excessive dilution during future funding rounds.

- Optional Conversion or Prepayment – Some notes allow voluntary conversion or repayment before maturity, providing flexibility for both parties.

- Subordination and Seniority – The note typically ranks below senior secured loans but above common equity in repayment priority.

Legal and Practical Considerations

Convertible Notes must be drafted carefully to ensure compliance with securities regulations and to define investor rights clearly. They should specify governing law, events of default, dispute resolution, and information rights. Since the instrument creates both debt and potential equity, parties must understand the tax and accounting implications before execution. Notarization is generally not required in U.S. jurisdictions, as signed execution pages are sufficient for enforceability.

Advantages for Startups and Investors

For startups, the Convertible Note is a fast and inexpensive financing method that avoids complex valuation negotiations. It provides immediate working capital and postpones the equity allocation process until a major investment round. For investors, it offers a lower-risk entry point with the potential upside of early equity conversion at favorable terms.

Conclusion

A Convertible Promissory Note bridges the gap between debt financing and equity investment. It provides flexibility, efficiency, and protection for both the company and the investor, making it one of the most practical tools for early-stage fundraising.

Check out more pages of our website for related content:

References

- Investopedia – Investment Notes Explained: Types, Benefits, and Potential Risks – An updated guide that explores the fundamental mechanics of notes and how earlier investors are compensated for risk through equity conversion.

- Cooley GO – What You Should Know About SAFEs – A detailed comparison of common startup investment instruments that highlights the distinctive debt characteristics of convertible notes versus the equity-focused SAFE.

- Angel Capital Association – Model Convertible Promissory Note – A resource providing standardized legal templates and term sheets designed to streamline early-stage financing and negotiation.

- Visible – What Are Convertible Notes and Why Are They Used? – An article breaking down the “Qualified Financing” triggers and the specific mathematical impact of valuation caps .

- Gilion – Convertible Notes: What Startups Need to Know in 2025 – A contemporary look at how the 2025 fundraising environment is shaping the usage of convertible notes to help startups preserve valuations during market volatility..

has been added to your cart!

have been added to your cart!