Buy-Back Agreement: A Financial Tool for Business Growth

A Buy-Back Agreement is a contractual arrangement between a seller and a buyer that facilitates business expansion. It plays the role of a loan or prepayment for constructing or completing a plant by securing product sales in advance. The buyer pre-purchases the final product at a fixed price for a set duration. This ensures the repayment of the loan or prepayment, including accrued interest, through product sales.

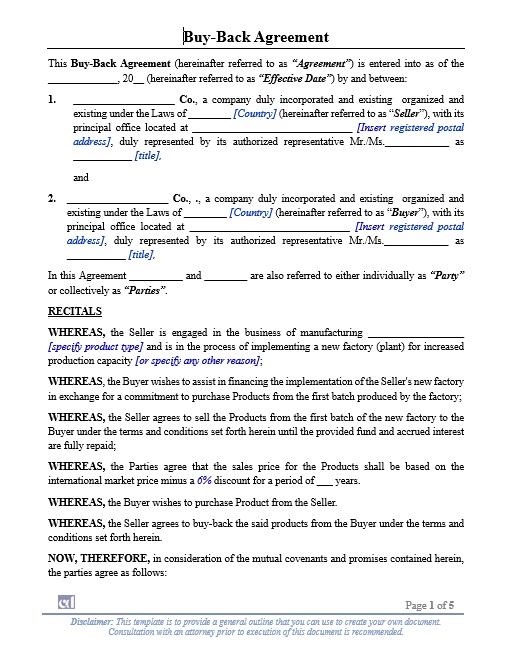

Key Elements of a Buy-Back Agreement

A well-structured Buy-Back Agreement defines the buy-back period, the duration during which the seller must supply products. It also includes initial funding, where the buyer finances the seller’s plant construction in exchange for future product purchases.

The repayment terms specify that the seller must repay the buyer by selling products at a discounted market price. Additionally, the contract establishes a fixed price and duration to ensure both parties benefit from the arrangement.

Financing and Repayment Through Product Sales

This agreement serves as a financing tool by allowing the seller to secure funds upfront for construction or expansion. The buyer, in return, gains a long-term supply of products at a predetermined rate.

The seller repays the prepayment through continuous product sales, covering both the principal amount and interest. This structure ensures financial security while guaranteeing the buyer’s supply needs.

Additionally, the agreement defines a repayment period, preventing long-term uncertainty.

Buy-Back Option and Conditions

The buyer retains the right to sell products to the seller under specific conditions. The buy-back price is calculated based on the international market rate with a discount.

To qualify for buy-back, products must be in good condition and properly maintained. The seller reserves the right to inspect them before completing the transaction. This ensures quality control and fairness.

Legal Framework and Dispute Resolution

The agreement operates under a defined legal jurisdiction, ensuring contractual clarity. It also includes a dispute resolution mechanism, typically through arbitration, to address conflicts efficiently. These provisions safeguard both parties from legal and financial risks.

Alternative Industrial Financing Options

While Buy-Back Agreements serve as a structured prepayment model, industries also use other financing tools, including:

- Term Loans – Fixed loans with structured repayment schedules.

- Equipment Financing – Loans secured by industrial machinery or equipment.

- Working Capital Loans – Short-term financing for operational expenses.

- Project Finance – Large-scale funding based on projected cash flow.

Each financing method supports different business needs. A Buy-Back Agreement is ideal when a company seeks funding while guaranteeing future sales.

References

- U.S. Small Business Administration (SBA)

https://www.sba.gov/ - International Finance Corporation (IFC)

https://www.ifc.org/ - Investopedia – Industrial Loans

https://www.investopedia.com/

You may find another version of the Buy-Back Agreement HERE.

has been added to your cart!

have been added to your cart!