Estimated reading time: 2 minutes

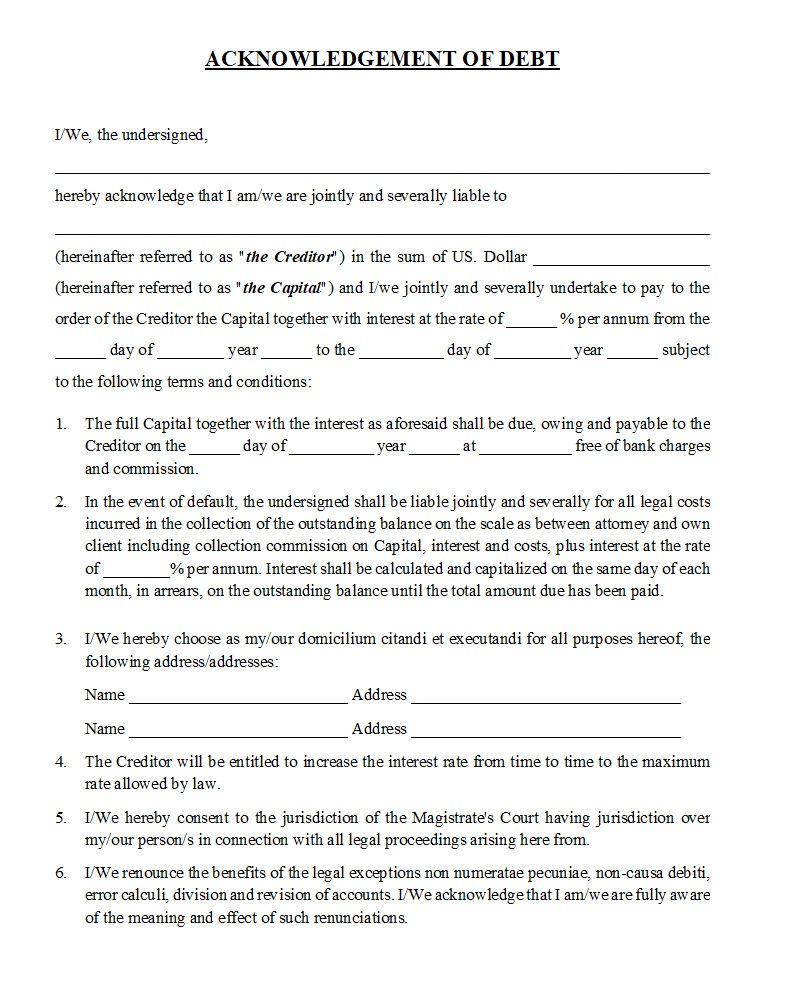

An Acknowledgement of Debt gives written confirmation that a debtor owes a specific amount to a creditor. The document states the outstanding sum, outlines the repayment expectations, and confirms the debtor’s commitment. Consequently, it creates a clear and enforceable financial obligation that both sides can rely on. Because it records the debt in writing, it prevents later disputes and strengthens the creditor’s position if repayment problems occur.

Purpose and Financial Value of an Acknowledgement of Debt

This document plays a central role in establishing certainty between the parties. It records the essential details of the debt, including dates, amounts, repayment schedules, and any negotiated interest. Moreover, it supports transparent communication and stops misunderstandings before they escalate. As a result, the creditor gains certainty about repayment, while the debtor shows responsibility and intent to honor the obligation. Since both parties understand the same financial terms, the document creates a foundation for a stable relationship.

Legal Effect and Enforceability

Courts treat a written acknowledgement as strong evidence that the debt exists. Therefore, when the parties sign it voluntarily and agree on the repayment terms, it carries significant legal weight. Additionally, it can support enforcement actions if the debtor fails to pay. Since the acknowledgement states the amount owed and the repayment method, the creditor does not need to rely on verbal promises or incomplete records. In many jurisdictions, a well-drafted acknowledgement can even interrupt or extend the prescription/limitation period, giving additional protection.

Practical Use in Commercial and Personal Finance

Businesses rely on Acknowledgements of Debt to formalise overdue accounts, restructure payments, or record liability between partners. Individuals use them to secure private loans or document informal financial arrangements. Because the document outlines obligations clearly, both sides benefit from predictable expectations. Furthermore, legal advice helps ensure that the document aligns with local regulations and protects the interests of both parties. When the debtor and creditor act according to the agreed terms, the process strengthens cooperation and reduces the risk of conflict.

Check out more pages of our website for related content:

Access the Full Contract Directory Index

You can browse the complete alphabetical list of all commercial, financial, and project-based contract templates by visiting our A–Z Contract Index.

Reference:

has been added to your cart!

have been added to your cart!